Top FAQs

VyStar’s routing number is 263079276.

Visit our Direct Deposit page for instructions on setting up direct deposit, including how to find your account number.

If you see unauthorized transactions on your account or believe you are a victim of fraud, there are several ways you can report it:

Call the Contact Center at 904-777-6000 or 800-445-6289, option 2, Monday through Saturday, from 7:00 a.m. to 7:00 p.m. EST, excluding holidays.

Visit your local branch and report the fraud to a Member Service Representative.

If you need help with your VyStar account, you can call our Contact Center at 904-777-6000 or 800-445-6289. The Contact Center is open Monday through Saturday, from 7:00 a.m. to 7:00 p.m. EST, excluding holidays.

If you need to speak with someone at a specific branch, you can find the phone numbers for each of our branches on the Locations page. Just search for your branch to view the phone number, branch hours and other details.The phone numbers for our Contact Center are the same, whether you’re calling from within the U.S. or from overseas (+1 904-777-6000 or +1 800-445-6289).

However, overseas calls are handled differently by different phone providers, which means that services, fees and dialing instructions vary depending on your provider and your plan. Check with your phone provider for details on making international calls.Please call our Contact Center at 904-777-6000 or 800-445-6289, option 9. The Contact Center is open Monday through Saturday, from 7:00 a.m. to 7:00 p.m. EST, excluding holidays.

Schedule an Appointment

Come see us! Reserve a date and time to visit a local branch.

Manage Your Account

Learn how to manage your VyStar account, from setting up direct deposit and protecting yourself from identity theft to switching to e-statements and setting up a wire transfer.

Holiday Schedule

Closed on February 16th for Presidents Day

Closed on April 5th for Easter

Closed on May 25th for Memorial Day

Banking

Call Us

904-777-6000 or 800-445-6289

Monday through Saturday, from 7:00 a.m. to 7:00 p.m. EST, excluding holidays

TDD Telephone Service

904-908-2320 or 888-872-5738 for the hearing and speech impaired

Mailing Address (USPS)

VyStar Credit Union

P.O. Box 45085

Jacksonville, FL 32232-5085

UPS, FedEx & Priority/Express Mail

VyStar Corporate Headquarters: VyStar Tower

76 S. Laura Street

Jacksonville, FL 32202

Follow the instructions on the Enrollment page to get started. You’ll need a valid email address to enroll.

To activate your VyStar Debit Card, call 800-992-3808 or 844-373-1729.

To set up or change your PIN on your VyStar Debit Card, call 844-373-1729. Your card has to be activated within 90 days.

To transfer money between your VyStar accounts and other financial institutions:

Log into Online Banking.

From the account dashboard, select Pay & Transfers, then External Transfers.

On mobile, select Transfer, then External Transfers.

Select the “to account” and “from account” from the list of connected accounts.

Enter desired transfer date and transfer amount.

Select frequency and Continue.

View the transaction confirmation, select Done.

Some branches offer safe deposit boxes in various sizes. Please visit a branch near you to discuss options. If you have a question about access and issue with a safe deposit box, you will need to contact the branch where your safe deposit box is located. Direct phone numbers to our branches can be found on our Locations page.

We have certified notaries at all VyStar branches. Check our Locations page for branch hours and to schedule an appointment. After selecting Schedule an Appointment, choose Other Financial Needs and then Notary to schedule time in advance of visiting a branch.

Use the portal to self service your HSA or IRA accounts.

Yes, for VyStar members. There are some limitations for exchanges over $1,000. We don't offer foreign currency exchange.

Personal & Auto Loans

Call Us

904-777-6000 or 800-445-6289

Monday through Saturday, from 7:00 a.m. to 7:00 p.m. EST, excluding holidays

TDD Telephone Service

904-908-2320 or 888-872-5738 for the hearing and speech impaired

Mailing Address: Loan Payments

VyStar Credit Union

P.O. Box 45085

Jacksonville, FL 32232-5085

Mailing Address: Loan Payoffs

VyStar Credit Union

P.O. Box 45085

Jacksonville, FL 32232-5085

Overnight Delivery: Loan Payoffs

VyStar Credit Union

76 S. Laura Street

Jacksonville, FL 32202

To make a payment for your personal loan or auto loan from one of your VyStar accounts:

Log into Online & Mobile Banking.

Select the “from account” and “to account” from the list of connected accounts.

Enter Transfer Amount and Frequency.

Enter/select date. (Recurring transfers will need a start and end date), then Continue.

Review the transaction confirmation and select “Done.”

To make a payment for your personal loan or auto loan online from an account at another financial institution:

Log into Online Banking.

Select the “to account” and “from account” from the list of connected accounts.

Enter/Select date of transfer. *Recurring transfers will need a start AND an end date.

Enter transfer amount.

Then select frequency and Continue.

Review the transaction confirmation and select Done.

If you are not a VyStar member, use this page to make a VyStar loan payment.

For personal loans, auto and other vehicle loans, you can apply through Online Banking.

Log into Online Banking.

Click Apply for Loan in the menu bar at the right. Be sure your pop-ups are enabled.

Select the Loan Type from the drop-down menu to get started.

If you’re having trouble managing your loan payments, please get in touch by giving us a call at 800-445-6289 or visiting one of our local branches.

We may be able to help you out with emergency cash, a debt consolidation loan, refinancing or other solutions to help you get back on track. We can also set you up with our free financial counseling service, where you can talk with a personal finance expert who can help you set financial goals and work toward achieving them.Yes, you can change the due date on your personal loan or auto loan. Just give us a call at 904-777-6000 or 800-445-6289 or change your due date online.

For a loan payoff, please contact Member Services at (904) 777-6000 option 3 or visit one of our branches.

Mortgages & Home Loans

Call Us

904-777-6000 or 800-445-6289

Monday through Saturday, from 7:00 a.m. to 7:00 p.m. EST, excluding holidays

TDD Telephone Service

904-908-2320 or 888-872-5738 for the hearing and speech impaired

Mailing Address: Loan Payments

VyStar Credit Union

Mortgage Loan Servicing

P.O. Box 41266

Jacksonville, FL 32203-1266

Mailing Address: Loan Payoffs

VyStar Credit Union

P.O. Box 41145

Jacksonville, FL 32203-1145

Overnight Delivery: Loan Payoffs

VyStar Credit Union

76 S. Laura Street

Jacksonville, FL 32202

We may be able to help you buy a home, even if your credit isn't perfect. Keep in mind that lenders don't just look at your credit history, but also at your ability and willingness to pay in the future.

VyStar uses your credit report to see how you have handled your credit obligations in the past and to evaluate your ability to repay your loan.

A prequalification tells you how much you might qualify for based on unverified information that you provide, so it is not a firm guarantee of a loan. With a preapproval, we check your credit, verify your income and employment and commit to lending you a specific amount of money. A preapproval shows sellers that you can borrow the amount you need, so it gives you more buying power.

Your total monthly payment is often higher than the principal and interest. The total monthly payment often includes other things, such as homeowner’s insurance and taxes.

Yes, we offer a variety of options that allow you to tap into your home's equity and take cash out. Talk with one of our Mortgage Loan Officers to discuss the best cash-out refinancing option for you.

Cash-out refinancing can help homeowners who want to consolidate high-interest debt. Because your mortgage interest rate is likely to be lower than rates on credit cards or other types of bank loans, consolidating debt may reduce your overall monthly debt payments.

Credit Cards

Call Us

904-777-6000 or 800-445-6289

Monday through Saturday, from 7:00 a.m. to 7:00 p.m. EST, excluding holidays

TDD Telephone Service

904-908-2320 or 888-872-5738 for the hearing and speech impaired

Mailing Address: Credit Card Payments

VyStar Credit Union

P.O. Box 71050

Charlotte, NC 28272-1050

To activate your VyStar Credit Card, call 800-527-7728 or 800-631-3197.

You can view the credit limit for your credit card by logging into Online Banking or the Mobile Banking App and navigating to your credit card account. Your available balance is at the top of the account screen.

You can set up a travel notice through Online Banking.

Log into Online Banking.

Select your credit card account.

Click the Communications tab.

Click Travel Notes.

Select the appropriate card and click Next.

Enter your authentication information.

Enter your trip information.

To set up or change your PIN on your VyStar Credit Card, call 888-886-0083 and follow the instructions.

Switching to e-Statements helps the environment by reducing paper and fuel consumption, and it helps us save money on production and postage expenses. Because we’re a not-for-profit credit union, all the money we save benefits you and our other members.

To switch to e-Statements:Log into Online Banking or open the Mobile Banking App.

Click your credit card account name.

Click Statements & Activity.

Click Go Paperless

Investments

Call Us

Monday through Saturday, from 7:00 a.m. to 7:00 p.m. EST, excluding holidays

TDD Telephone Service

904-908-2320 or 888-872-5738 for the hearing and speech impaired

Mailing Address

VyStar Investment Services

76 S. Laura Street

Jacksonville, FL 32202

We work with investors in two ways:

Advisory Relationships: Your investment advisor monitors your investments and provides advice about them on an ongoing basis. The fees for this service are based on the value of your investment portfolio.

Brokerage Relationships: Your broker makes trades on your behalf, but you decide which investments to buy or sell. Your broker can give you advice at the time of trade, but they don’t actively monitor your investment portfolio. The fees for this service are based on the number of transactions you make.

Visit the VyStar Investment Services Service Strategies page for more details.

Yes, the Financial Advisors at VyStar Investment Services offer comprehensive financial planning services. You can talk with a Financial Advisor by phone at 904-908-2495 or email VISMarketing@vystarcu.org.

Visit the VyStar Investment Services Tools & Resources page for help and educational tools that can help you learn more about investing.

Insurance

Call Us

Call 877-997-2221 to speak to a licensed agent

Monday through Friday, from 9:00 a.m. to 5:00 p.m. EST, excluding holidays

TDD Telephone Service

904-908-2320 or 888-872-5738 for the hearing and speech impaired

We’re happy to guide you through the process of submitting a claim. Call us at 877-997-2221 or email us at insurance@vystarcu.org.

Your coverage depends on your policy, and we are happy to answer any questions. Call us at 877-997-2221 or email us at insurance@vystarcu.org.

With hundreds of trusted carriers in our network, we’ve got you covered. Call us at 877-997-2221 or email us at insurance@vystarcu.org.

All new accounts are subject to approval.

All loans are subject to credit approval. All rates are based on an evaluation of the member’s individual credit history. Terms are subject to conditions and verification restrictions may apply. All credit union programs, rates, terms and conditions are subject to change at any time without prior notice.

Wireless provider data and text rates may apply. Certain restrictions may apply. 3G and new devices can view VyStar Credit Union's full website and all our products and online services.

*Projected savings are based on insurance policies placed by VyStar Insurance Agency, LLC in 2022. VyStar Insurance Agency, LLC is an affiliate of VyStar Credit Union and is not federally insured nor is it underwritten or guaranteed by VyStar Credit Union.

Check the background of investment professionals associated with this site on FINRA’s BrokerCheck.

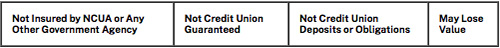

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. VyStar Credit Union and VyStar Investment Services are not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using VyStar Investment Services and may also be employees of VyStar Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, VyStar Credit Union or VyStar Investment Services. Securities and insurance offered through LPL or its affiliates are:

LPL Financial Registered Representatives associated with this site may only discuss and/or transact securities business with residents of all 50 United States. The services offered within this site are available through our U.S. Investment Representatives, LPL Financials U.S. Investment Representatives may only conduct business with residents of the states for which they are properly registered. Please note that not all investments and services mentioned are available in every state.

VyStar Credit Union (“Financial Institution”) provides referrals to financial professionals of LPL Financial LLC (“LPL”) pursuant to an agreement that allows LPL to pay the Financial Institution for these referrals. This creates an incentive for the Financial Institution to make these referrals, resulting in a conflict of interest. The Financial Institution is not a current client of LPL for brokerage or advisory services. Please visit https://www.lpl.com/disclosures/is-lpl-relationship-disclosure.html for more detailed information.