Building an emergency savings fund is a good idea, but how much should you have? The amount needed depends on a variety of factors, including your monthly income and expenses, job stability and risk tolerance.

One of our VyStar Financial Fitness resources is an Emergency Savings Fund Tool, which can help you determine the right size for your emergency savings. The best part? It’s simple to use.

As you use the tool, you can follow the exercise below for step-by-step guidance.

How to calculate your emergency savings fund

Meet Michael and Jennifer

Michael and Jennifer are a married couple who live in Central Florida. They have a 2-year-old son, Christopher. Michael works in IT, and Jennifer is a teacher. Their combined annual salary is $145,000 before taxes.

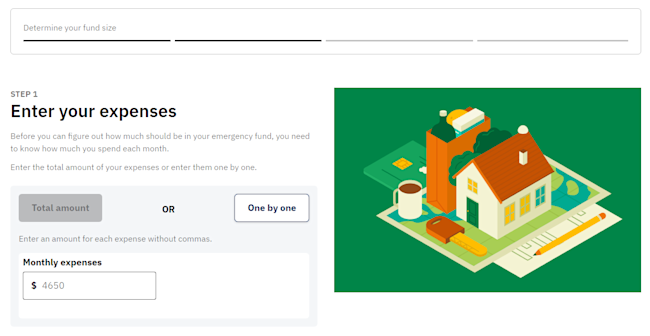

Step 1: Enter your expenses

To calculate your emergency savings, start by entering your monthly expenses. You can either input your total expenses or enter them individually. For this example, we’ll enter them one by one.

Housing and utilities

Michael and Jennifer live in a three-bedroom, two-bath household. They have a phone and internet bundle.

Mortgage: $1,400

Utilities: $225 (average)

Phone and internet: $125

Total: $1,750

Transportation

Michael works a hybrid role and goes into the office three days each week. Jennifer goes to school five days a week during the school year. Each is a short drive, which saves on gas. Michael has a car payment while Jennifer recently paid off her car. Neither takes public transportation.

Fuel: $200 ($100 per person)

Car payment: $400 (One $225 payment, one car paid off; about $175 in insurance)

Public transportation: $0

Total: $600

Food

Jennifer meal preps for every day she is at school, while Michael occasionally visits a local food truck when he's working from the office. An average weekly grocery bill for the family of three is $150.

Groceries: $600 ($150 per week average)

Health

Since Michael and Jennifer have a Health Savings Account (HSA) that is automatically deducted from their payroll, they typically use it to cover health expenses.

Doctor visits: $0

Prescriptions: $0

Other

Because both parents work, Christopher goes to a local daycare. Also, Michael is finishing up paying off student loans and credit card debt, which comes out to about $500 per month.

Childcare: $1,200

Miscellaneous: $500

Total: $1,700

Total expenses

Total monthly expenses: $4,650

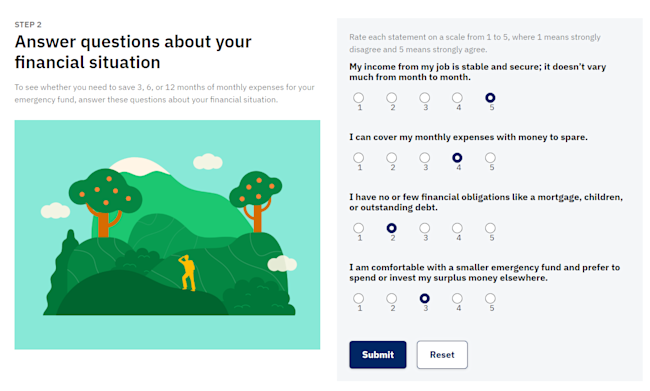

Step 2: Assess your financial preferences

Now that you’ve entered expenses, the next step is to assess your financial situation. You’ll need to determine whether you need 3, 6 or 12 months of expenses in your emergency fund.

My income from my job is stable and secure; it doesn’t vary much from month to month.

Both Michael and Jennifer in stables careers with regular income. They answer a 5 here.

I can cover my monthly expenses with money to spare.

Since Christopher was born, the family has not been able to save like they once did. Some months, expenses climb higher than anticipated. But they are mostly comfortable, so they answer a 4 here.

I have no or few financial obligations like a mortgage, children, or outstanding debt.

Michael and Jennifer have a mortgage, student loans and pay for childcare. Here, they answer a 2.

I am comfortable with a smaller emergency fund and prefer to spend or invest my surplus money elsewhere.

Michael and Jennifer are confident in their respective careers, but they have some risk aversion. Here, they answer a 3.

Based on their answers, Michael and Jennifer are recommended to need six months coverage in their emergency savings fund.

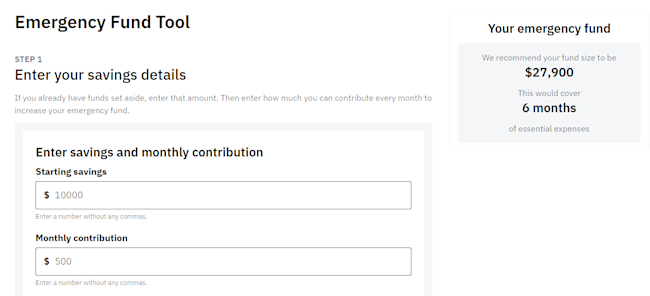

Step 3: Enter your savings details

The last step is to enter your savings information. This will help you understand how long it will take to build the emergency savings fund that fits you.

Michael and Jennifer have about $10,000 in savings. They each contribute $250 per month to savings.

Savings: $10,000

Monthly contribution: $500 ($250 each)

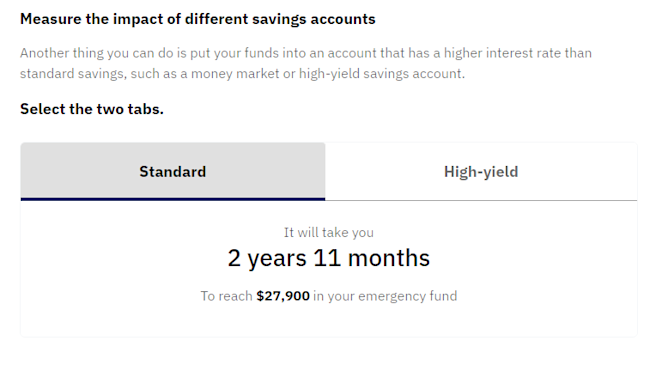

Step 4: How long you need to build your emergency savings fun

Based on our Emergency Savings Fund Tool, it will take Michael and Jennifer 2 years, 11 months to reach their emergency fund goal of $27,900.

Begin building an emergency savings fund today

Now that you’ve figured out how much to save and how long it will take, you can begin to tackle your financial goals. You can determine whether you want to build savings in a regular savings account or a money market or high-yield savings account.