We ask a lot of our military service members, and we rely on them to protect us both here and abroad. Unfortunately, the demands of that service can make them vulnerable to identity theft. In 2013, the Federal Trade Commission released a study saying that military personnel report identity theft twice as often as the general public.

Because of the unpredictable nature of their service, military members can be called away quickly for short or long periods of time. They may have temporary addresses and lack good communications infrastructure. As a result, some return home to discover that they’re victims of identity theft and have to deal with the financial issues and credit problems that come with it.

Active Duty Alerts

There is some good news. The three major credit bureaus have a free program for service members who are deployed away from their primary duty station called the Active Duty Alert program. It’s specifically designed to reduce the risk of military identity theft. Members only have to contact one of the credit agencies below, online or by phone, to sign up:

Equifax: 800-525-6285

Experian: 888-397-3742

TransUnion: 800-680-7289

Once you’ve signed up, the credit bureau you contacted will inform the others to enroll you in their alert programs as well. The alert will remain in effect for one year unless you cancel it.

How Active Duty Alerts Protect You

The Active Duty Alert program provides two additional protection services:

It requires businesses to verify your identity before issuing credit in your name.

It stops the mailing of unsolicited and prescreened credit offers for a period of two years.

You also have the option to designate a personal representative to act on your behalf while you’re away. If you want to cancel, just contact the credit bureau either online or by phone.

If you are still concerned about identity theft, you may want to explore a credit or security freeze. There are several options for alerts and freezes, so make sure to do your research and select the one that works best for you.

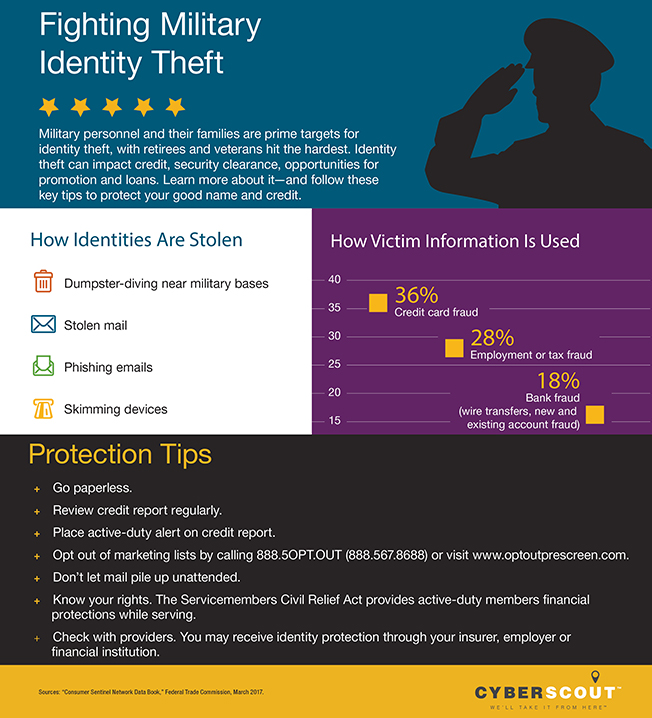

Check out the infographic below for more military identity theft facts and prevention tips from CyberScout, the nation’s leading provider of identity services. You can also visit our Fraud Protection page for more information on how VyStar can help protect you against identity theft and other types of fraud.